Wells Fargo

At Wells Fargo Advisors, we provide advice and guidance to help maximize all elements of your financial life, whenever and however you need it. It’s natural and wise to reexamine your financial outlook after an unexpected or game-changing life event. Or to hear life’s clock ticking and feel the urgency to plan more deliberately to better work toward your most cherished goals.

A Financial Advisor can provide the advice and guidance you need to focus on your short- and long-term goals while navigating life’s financial opportunities and turning points. Start planning now for the future. Choose a Financial Advisor from the firm that lives and breathes a client-centered approach to advice. Your Financial Advisor is here to help you navigate through market uncertainty and provide you with perspective for moving forward. We believe every client deserves our commitment to work together to help you meet your financial goals. When you work with Wells Fargo seating, we build an enduring relationship together, based on trust and client-first, objective advice.

There are essentially two types of advisory programs of Wells Fargo. The first lets you give another party discretion over your account’s day-to-day management. In other words, you can allow a portfolio manager possibly your Financial Advisor to make decisions regarding buying, selling, and holding investments without consulting you. The foundation of this partnership is collaboration – making sure your Financial Advisor of Wells Fargo seating understands who you are, where you are now, and what you want to achieve. Important elements of wells Fargo Seating helping you succeed financially include:

Creating and maintaining your investment profile:

Throughout the duration of your relationship with your Financial Advisor, we like to see all household plans and accounts with up-to-date profiles outlining your investment objectives, including risk tolerance and goals. This will help your Financial Advisor help you manage your portfolio over time, relative to your goals and investing personality.

Aligning investments:

When your investments are consistent with your investment profile and financial goals, it helps ensure a smoother road toward your financial success. Meeting with your Financial Advisor regularly can help your portfolio stay aligned over time as your profile, investments, and goals change.

Client reviews:

It’s a good idea to meet with your Financial Advisor at least annually to confirm your investment objective and risk tolerance, identify any changes that may have occurred with your financial situation and investment profile, and ultimately, to help determine whether you’re staying on track. Client reviews can be a productive and collaborative time for you and your advisor to discuss your goals, your investments’ performance, and the way you work together.

Clear, direct communication–your way

Working with a Financial Advisors of Wells Fargo seating looks different for each individual, but we’ll work together the way you want; either in person, by phone, via email, or a combination that suits your needs.

A planning-centric approach

We believe the best way to get where you want to go is to have a plan. Some plans can be simple and others can be extremely complex, depending on the variables in your full financial picture. Your Financial Advisor has a comprehensive array of tools, resources, and strategies to help execute your plan, whether it includes investing, wealth accumulation, saving for college, principal drawdown, tax-efficient investing, insurance, estate planning strategies, or health care aspects—whatever is important to you.

In-house research, expertise, portfolio, and analytic services

Our strategists and analysts provide viewpoints on current market conditions, create regular publications to help investors build their financial acumen, and offer periodic client education calls.

Planning process of Well Fargo:

As you start thinking about your future and how to plan for what’s most important, you should focus on your unique life goals and how you would prioritize them. You and your Financial Advisor of wells Fargo can sit down together to explore your most important goals, and then create an investment plan to support them.

Looking for Mortgage Analysis Services

Wells Fargo planning process is intended to help your Financial Advisor keep you on track toward a future you can look forward to one you’ve chosen yourself. Best of all, our process is flexible, allowing us to easily update your plan whenever your goals or circumstances change.

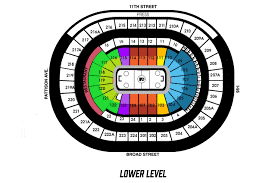

Along with talking with your Financial Advisor, you’ll be able to see your plan details online to help you track your progress. You’ll also have the flexibility to test drive how certain changes in your life may impact your plan. This is the seating chart of Wells Fargo that process to provide its products and services to its clients and customers as well.

Financial Advisors of wells Fargo provide advice and guidance on a full range of products and services to help maximize the elements of your financial life. It provides different types of services and products includes:

- A wide ranges of investment:

Part of the investment planning process is making investment choices that fit your investment strategy. Multiple investment types can work together to help you accomplish your financial goals. We’re dedicated to providing you a wide range of investment products and services to help you meet them.

- You have many options for investing.

- Investments should work together to help you accomplish your financial goas.

Working Toward Retirement Goals with IRAs:

Retirement as we’ve known it is changing. You will probably be more active and live and work longer, and you may need to rely more on what you’ve saved for income than prior generations. If you have a QRP, such as a 401(k), 403(b), or governmental 457(b), at work and regularly contribute, that might not be enough to accumulate the savings you need. Fortunately, you can contribute to both your QRP and an IRA.

- You can contribute to a qualified employer-sponsored retirement plan (QRP) and an IRA.

- IRAs allow you to take advantage of tax-deferred or tax-free growth potential.

- Consider creating a retirement savings account if you don’t have one with your employer.

Retirement vs. education – balancing priorities

Wells Fargo seating gives advisory of Saving for retirement and college at the same time can be a challenge for many families. While you want to help your child reach their full potential, most financial experts agree if funds are limited, saving for retirement should be the higher priority.

For information on foreclosure defense call us at (877) 399 2995. We offer litigation document review support, mortgage audit reports, securitization audit reports, affidavit of expert witness notarized, and more.